The Psychology of Spending: Why We Buy What We Buy (And How to Outsmart Your Brain)

Have you ever bought something you didn’t plan on — a random gadget, a snack, a sale item — and later thought, Why did I even buy this?

You’re not alone. Humans don’t spend money logically. We spend emotionally, impulsively, habitually, and often without realizing why.

Understanding the psychology behind your spending doesn’t just save money — it gives you power. Once you know what triggers your purchases, you can outsmart your brain and build a healthier financial life.

Let’s break down the invisible forces influencing your wallet.

1. The Dopamine Hit: Your Brain Loves the “Chase,” Not the Purchase

When you see something you want, your brain releases dopamine — the feel-good chemical of anticipation.

That means:

- the idea of buying feels better than owning

- browsing becomes addictive

- clicking “add to cart” gives a rush

- sales feel exciting even if you don’t need anything

Marketers count on this. That’s why flash sales and countdown timers work so well. They activate impulse circuits.

How to outsmart it:

Wait 24 hours before buying anything that isn’t a necessity. If you still want it, buy it.

Most people forget about the purchase within hours.

2. Emotional Spending: Buying to Feel Something

People spend for emotional reasons every day:

- boredom

- stress

- loneliness

- celebration

- insecurity

- frustration

Shopping becomes a coping mechanism — a temporary mood boost that fades fast.

How to outsmart it:

Before buying, ask:

“What emotion am I trying to feel right now?”

If the answer isn’t related to the item, pause.

3. The Scarcity Trap: “Limited Time Only!”

Scarcity is one of the strongest psychological triggers. When something seems rare, exclusive, or urgent, the brain panics:

- “If I don’t buy it now, I’ll lose out.”

- “Everyone else is getting it.”

- “This deal will never come back.”

Spoiler: it always comes back.

How to outsmart it:

Remind yourself:

“If this truly matters, it will still matter tomorrow.”

The urgency will dissolve.

4. The Social Mirror: Spending to Fit In

We don’t just buy things — we buy identity.

Clothes, gadgets, cars, vacations, gifts — they all communicate something.

Social pressure influences you through:

- influencers

- friends

- coworkers

- social media

- cultural expectations

This makes you feel “behind” unless you keep up.

How to outsmart it:

Unfollow accounts that trigger comparison.

Your wallet shouldn’t carry the weight of someone else’s lifestyle.

5. The Pricing Illusion: Why $9.99 Always Wins

Psychological pricing tricks you into thinking something is cheaper than it is.

Examples:

- $9.99 feels closer to $9 than $10

- “Buy one, get one” feels like free money

- Bundles feel like a bargain

- Subscriptions feel painless until they pile up

Your brain loves shortcuts — and marketers use them.

How to outsmart it:

Round every price up.

$29.97 = $30

$199 = $200

It instantly clarifies true cost.

6. Mental Accounting: Treating Money Differently Based on Where It Comes From

People treat money differently depending on its source:

- tax refunds = “fun money”

- bonuses = “extra money”

- credit card points = “free money”

- cash = “less real”

- debit = “more real”

But money is money. Your brain just assigns different emotional weight to different buckets.

How to outsmart it:

Use one rule:

Every dollar has a job.

No exceptions.

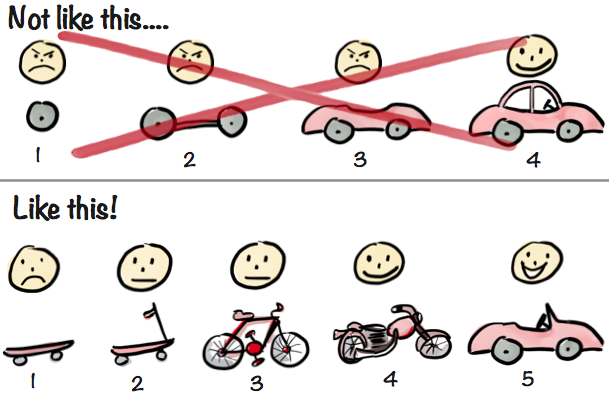

The Fix: Spend With Intention, Not Impulse

Improving your financial life isn’t about restriction — it’s about awareness.

When you understand why you spend, you gain control over:

- your habits

- your savings

- your long-term goals

- your emotional triggers

- your relationship with money

You start buying based on value, not impulse.

You stop letting emotions hijack your wallet.

You stop falling for psychological traps engineered to make you spend more.

Spending doesn’t have to be the enemy — unconscious spending is.